Terms and Conditions of Resonate Supporter Shares

Purpose of this Document

To define the terms and conditions for the qualification, issue, acceptance, holding and redemption of Resonate Supporter Shares and the rights and obligations of parties involved.

Audience

Prospective Supporters of Resonate who may qualify for subscription to Supporter shares by grant or purchase.

Members of the Co-operative accountable for administration of supporter shares.

Members of the Co-operative and the public seeking transparency in Resonate Co-operative finance.

Scope and Limitations

This document is restricted to subscription to Supporter Shares. References to other instruments or shares are for context or for specific relationships and are not definitive or complete in respect of the terms and conditions of other instruments or shares. Please refer to the specific documents concerned.

These Terms and Conditions will be interpreted and limited in line with the Objects, limited liability of members and powers of the Co-operative as set out in Art 5, 6 and 7 of the Rulebook

This document describes the general principles, terms and conditions of Supporter Shares. It is not an operating manual and does not set out detailed or binding operating procedures.

These terms and conditions shall supersede all terms and conditions associated with supporter shares issued prior to 31st December 2020

These terms and conditions are governed and will be interpreted in accordance with the laws of the European Union and the Government of Ireland without reference to their conflicts of laws, rules or principles. In the event of dispute, the relationship dispute procedure will follow the provisions of Article 58 of the Rulebook ‘Relationship Disputes’.

Key Principles

Supporter shares are an incentive to attract, reward and retain those who bring financial value or effort to the Co-operative. They are a source of non-extractive, long-term, stable finance or resources for the Co-operative.

With a par value of €1 they may be purchased by or granted to natural legal persons who are members of the Co-operative in recognition of a qualifying labour or financial contribution to the Co-operative.

They do not confer a role, vote or influence in Co-operative governance.

They are generally non-transferable and may not be traded.

Redemptions and interest are strictly limited according to these terms and conditions.

Definitions

Co-operative – Resonate Beyond Streaming Limited 5690 R – incorporated in Ireland under the Industrial and Provident Societies Act 1893-2014 (The Act), governed and administered in accordance with the Act and the rules of the Co-operative (the Rulebook) and also referred to as ‘We’ in this document.

The Board - The Board of the Co-operative is the committee of management of the Co-operative.

Prospective Member – a prospective member is a natural or legal person who intends in good faith to become a member of the Co-operative. Prospective members are referred to as ‘You’ in this document for the purpose of applying for membership…

Prospective Supporter – a prospective supporter is a natural or legal person with the legal authority and legal capacity to qualify for grant or purchase of a subscription to Supporter Shares in the Co-operative. Prospective supporters are also referred to as ‘You’ in this document for the purpose of applying for supporter shares.

Membership – membership is the state of being a member of the Co-operative and owning a share entitling that member to participate in the governance of the Co-operative.

Surplus - “Surplus” is equal to Profit, less Pay including their Associated Costs, less Corporation Tax. Distribution of Surplus is described in the General Terms below under ‘Surplus’.

Founder Shares - are membership shares owned by the Co-operative’s founding members, the signatories to the original application.

Artist-Member Share – an Artist-Member Share is a share issued to a prospective member that (i) has signed up as an artist or label at http://www.resonate.is, (ii) distributes music and/or related products and services through the Co-operative’s platform and (iii) has executed their membership commitment via the Membership Portal. This share entitles them to participate in the governance of the Co-operative and to qualify for distribution of a share of surplus at the discretion of the Co-operative . This share will be held subject to the conditions set out in the Rulebook of the Co-operative.

Listener Share– a Listener Share is a share issued to a prospective member that (i) has paid an initial qualifying membership contribution, (ii) declares that they intend to use the Co-operative’s platform and related products and services and (iii) has executed their membership commitment via the Membership Portal. This share entitles her or him to participate in governance and to qualify for distribution of a share of surplus at the discretion of the Co-operative. This share will be held subject to the Rulebook of the Co-operative. Note: Listener shares were previously described as ‘Fan’ shares in early versions of the Rulebook. A natural person may hold a Founder membership share, a Listener membership share and an Artist-Member share but must choose or be allocated a single primary membership class in which a member’s vote will be counted during ordinary resolutions and special resolutions in General Meeting.

Membership Qualifying Contribution – the membership qualifying contribution is the amount which must be paid initially, and thereafter on an annual basis, by a prospective Listener member of the Co-operative. The initial payment will consist of a €1 share, accounting for the prospective member’s Listener Share” (whichever is applicable), and a €9 (previously €4) due (which may be subject to tax, as applicable).

Membership Data – membership data is all the data necessary to complete the membership application process consistent with the rulebook of the Co-operative and the Industrial and Provident Societies Act 1893-2014 (the Act) Such data shall include, but shall not be limited to; (i) Forename, (ii) Surname, (iii) Date of Birth, (iv) Residence, (vi primary personal email address. and appropriate proof of control of the primary email address by only one natural person. The Co-operative shall determine and apply appropriate methods of proof of identity, in accordance with the Act.

Payment Details – payment details include all information necessary to process payments through the membership portal, a third party payment service acting on behalf of the Co-operative or any other instrument necessary to effect payment. Such data shall include, but shall not be limited to; (i) Forename, (ii) Surname, (iii) Billing Address, (iv) Credit/Debit Card Number, (v) Expiration Date, (vi) Security Code.

Supporter Shares – Supporter Shares are a class of shares in the Co-operative. These shares shall entitle the holder to a preferred interest as outlined in the rulebook of the Co-operative. These shares shall bestow no voting rights in the governance of the Co-operative.

Membership Application Process – is the process by which a prospective member may become a member of the Co-operative. This consists of (i) Listeners – making a membership contribution, or, for Artists – registering as an artist/label at http://www.resonate.is, or both (ii) providing all necessary information required by law, the rulebook of the Co-operative and the terms and condition of the crowd campaign, (iii) making the necessary declarations required under the rulebook and (iv) has executed their membership commitment. Not all steps will be available for completion from the commencement of the crowd campaign.

Supporter Share Application Process – is the process by which a prospective supporter can subscribe for Supporter Shares in the Co-operative. This consists of (i) paying the total Supporter Share amount through the membership portal, (ii) providing all necessary information required by law, the rulebook of the Co-operative and the terms and condition of the crowd campaign and (iii) accepting the conditions for Supporter Shares in the rulebook. Supporter Shares are only available to legal or natural persons that have applied, or are applying, for membership in the Co-operative.

Membership portal – the membership portal is a web application that facilitates the membership and Supporter Share application processes for the Co-operative – including the taking of payment for membership contributions and Supporter Share payments and collecting required membership data.

Membership Commitment – the final step of the membership application process in which the prospective member accepts the terms of the rulebook of the Co-operative and executes their membership.

Declaration – a declaration made by a prospective member or investor required by the Rulebook of the Co-operative to qualify for membership.

Supporter Share Payment – an amount paid by a prospective supporter equal to the par value of the Supporter Shares applied for through the membership portal.

Preferred Interest – the interest paid to Supporter Shareholders by the Co-operative subject to conditions laid out in its Rulebook and this document.

Settlement Date – the date that the agreement to purchase Supporter Shares is executed by the prospective supporter and the Co-operative.

Rulebook – the governing documents of the Co-operative as required under the Industrial and Provident Societies Act 1893-2014.

The Site – The website of the Co-operative at the domain name “Resonate.is and Resonate.coop” and other sites, services, servers or domains of the Co-operative designated for use by members in accordance with the objects of the Co-operative as set out in the Rulebook.

General Terms of Supporter Shares

Number of Supporter Shares

A single natural or legal person who is a member of the Co-operative, approved by the Board, may hold a maximum of 100,000 Supporter Shares at a par value of €1 each. The total value of supporter shares held cannot exceed €100,000.

Issue

Issue is at par value of €1 to prospective supporters on payment and execution of their subscription or by grant at the discretion of the Board of the Co-operative in recognition of a qualifying labour or financial contribution, according to the governing documents of the Co-operative.

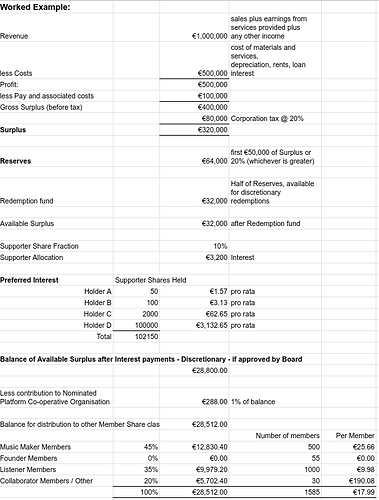

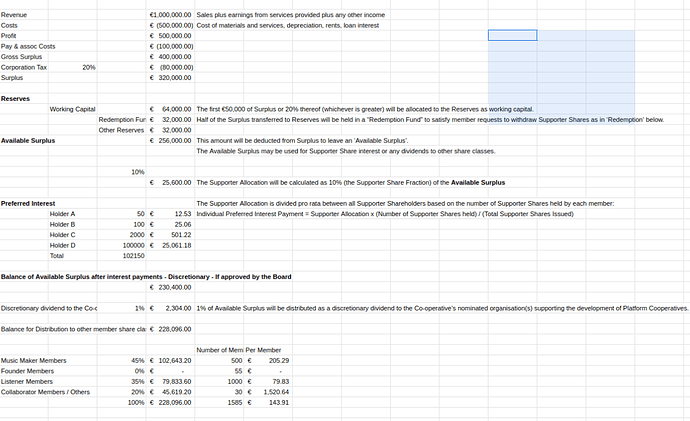

Surplus

“Surplus” is equal to Profit, less Pay including their Associated Costs, less Corporation Tax. The rules for distribution of Surplus to the Reserve and the Cooperative Commitment are that:

- The first €50,000 of Surplus or 20% thereof (whichever is greater) will be allocated to the Reserves as working capital. This amount will be deducted from Surplus to leave an ‘Available Surplus’. The Available Surplus may be used for Supporter Share interest or any dividends to other share classes.

- Half of the Surplus transferred to Reserves will be held in a “ Redemption Fund” to satisfy member requests to withdraw Supporter Shares as in ‘Redemption’ below.

- 1% of Available Surplus will be distributed as a discretionary dividend to the Co-operative’s nominated organisation(s) supporting the development of Platform Cooperatives.

Dividends

No dividends are payable on Supporter Shares.

Interest

Supporter Shares will have priority over the dividend payments to other share classes and nominated organisations in the allocation of the Available Surplus to an annual Preferred Interest payment. Any interest will be conditional on a surplus having been generated by the Co-operative and is payable at the discretion of the Board of the Co-operative according to the governing documents of the Co-operative.

- If the Surplus is less than €50,000 no interest payment is made for that year.

- The Supporter Allocation will be calculated as 10% (the Supporter Share Fraction) of the Available Surplus.

- The Supporter Allocation is divided pro rata between all Supporter Shareholders based on the number of Supporter Shares held by each member:

Individual Preferred Interest Payment = Supporter Allocation x (Number of Supporter Shares held) / (Total Supporter Shares Issued) - The interest must be paid within 6 calendar months of the end of the accounting period. Interest at the Cooperative’s Bank overdraft rate is to accumulate on unpaid amounts after this time.

If no interest payment is made to Supporter Shareholders in a given year, no dividend will be conferred to other share classes of the Co-operative.

Redemption

Supporter Shareholders may request to withdraw their capital after the first five years following the Settlement Date. Requests will be granted only at the discretion of the Board of the Co-operative and provided that:

- the Redemption Fund contains the necessary funds

- Any interest payments on supporter shares have been paid in full

If the total value of requested withdrawals exceeds the available capital in the Redemption Fund after interest payments, the shareholdings held longest will be satisfied first, on a pro rata basis.

If the Co-operative is dissolved, Supporter Shareholders will be entitled to a pro rata share of the residual assets of the Co-operative, after all other obligations outlined in the governing documents of the Co-operative are resolved.

Supporter shares are not redeemable on retirement or death of the shareholder, or in the event of the shareholder being declared bankrupt or found to be of unsound mind. A redemption request may be made by a supporter shareholder’s next of kin or legally appointed representative following the shareholder’s death, bankruptcy or the shareholder being found to be of unsound mind. If the redemption request is agreed in full or in part by the Board, the Supporter Shares will be redeemed at par value, then paid to a legally appointed trustee or held in trust by the Co-operative until such a person is duly appointed. Redemption requests on retirement or death are otherwise handled as all other redemption requests.

Disclosure

The 5 members who have held the most Supporter Shares over the last 5 years will be listed, together with their contact details, at the start of the register of members and may be required to provide a declaration of verification of identity for the Register of Beneficial Ownership (RBO) in Ireland.

Illustration:

The following example is intended as an aid to understanding the calculation model. It does not imply, infer or guarantee any specific values and is not a binding part of these terms and conditions.

Applying for Supporter Shares

Process

Prospective supporters must apply through the membership portal, subject to these terms and conditions and the Rulebook of the Co-operative.

The prospective member must provide all necessary billing information before proceeding with the payment of the membership contribution. All prospective members are required to ensure that this information is true and accurate and that the payment and information provided are in compliance with all applicable legislation, including, but not limited to, anti-money laundering, tax and registration of beneficial ownership. Payments for supporter shares may be made through to Co-operative’s payment portal and nominated card payment processor or to an account of the co-operative by special arrangement on request to the Secretary of the Co-operative.

By confirming payment for Supporter Shares, the prospective supporter agrees to (i) provide additional membership information as required to complete the membership application and (ii) that this information is true and correct. If not, the purchase of Supporter Shares by the prospective supporter is voidable at the discretion of the directors of the Co-operative. In such circumstances any payments will be refunded minus all reasonable costs incurred in making the refund.

After payment of the initial membership contribution, the prospective member will receive an email with a receipt outlining the details of their payment.

Limitations

The minimum number of Supporter Shares that may be applied for is €10.00 per prospective supporter.

The maximum number of Supporter Shares that may be applied for is €100,000 per prospective supporter.

The Board of the Co-operative reserves the right to restrict the intake of new supporters to the Co-operative at any time subject to the rules of the Co-operative and the laws of Ireland.

If a Board resolution is agreed to this effect prior to a prospective member executing their membership commitment, that prospective member will be unable to complete their membership process until the Board lifts this restriction.

In such an event the Co-operative will provide notice to the affected prospective member. That prospective member may then:

(i) wait for this restriction to be lifted (they will be provided with notice of this occurring) or

(ii) request that they be refunded the value of their membership contribution minus reasonable processing fees.

Disputes

In the event of dispute, the relationship dispute procedure will follow the provisions of Article 58 of the Rulebook ‘Relationship Disputes’:

In the event of a dispute between two or more members, the escalation procedure is:

- Mediation by the Chairperson, or Board member, a management consultant, trade union official, Co-operative Body official, Social Enterprise Europe Director, FairShares Association Founder, or other third party agreeable to all parties;

- Appeal (with resolution) subject to a vote at General Meeting;

- An EXTERNAL MEDIATION SERVICE chosen by the Board.

Dissolution

The members of the Cooperative may pass a Special Resolution at a General Meeting dissolving the Cooperative. Upon voluntary or involuntary dissolution, the provisions of Article 59 of the Rulebook will apply:

The members of the Cooperative may pass a Special Resolution at a General Meeting dissolving the Cooperative. Upon voluntary or involuntary dissolution, a qualified accountant or auditor will calculate the value of “residual assets” ([members’ capital] + [accumulated profit and loss account] + [assets – liabilities]). After satisfaction of all creditors, residual assets will be distributed to Supporter Shareholders in proportion to their shareholding, up to the nominal value of their shareholding, after satisfying the following requirements. Thereafter, the remainder will be assigned to an organisation with objects including the promotion of the development of platform cooperatives:

- In finalising the dissolution of the Cooperative, and subject to the requirements of Insolvency Law, debts and payments to creditors and shareholders will be satisfied in the following order:

- Outstanding debts to employees, workers and contractors (e.g. wages/fees)

- Outstanding debts to other priority creditors (e.g. VAT and taxes)

- Outstanding debts to suppliers (e.g. unpaid supplier invoices)

- Outstanding debts to other creditors (e.g. loan balances)

- Division of remaining residual assets to Supporter Shareholders. Any

remaining assets will be divided equally between Supporter Shareholders

in proportion to number of shares held at the end of the previous year’s

trading, up to the nominal value of their shareholding. For the avoidance

of doubt, changes in balances since the previous year-end will be ignored

for the purposes of calculating the share of residual assets paid out when

the Co-operative is dissolved.

Warranties given by Prospective Members and Supporters

Capacity

Before qualifying as a prospective member and supporter you warrant that you have the necessary legal and mental capacity to; (i) be a member of a Co-operative and/or (ii) make a purchase of Supporter Shares in a Co-operative.

Age

Before qualifying as a prospective member and/or supporter you warrant that, if you are a natural person, you are at least 16 years old if applying for membership and making a membership contribution, and you are at least 18 years old if subscribing for Supporter Shares.

True and Accurate Statements

Before qualifying as a prospective member and/or prospective supporter you warrant that all membership data, declarations, and any other information which you provided on the Membership Portal, are true, accurate and made in good faith.

Change in Terms

Before qualifying as a prospective member and/or supporter you warrant that you understand that the terms of the membership application process, and the Supporter Share application process may be changed by the Board and that the general terms of supporter shares in the Rulebook may be changed by special resolution under the terms of the Rulebook.

Applicable Laws

The laws of Ireland govern all these terms and conditions.

By accepting these terms and conditions you understand the conditions by which membership and the purchase of Supporter Shares are offered and the conditions under which they will be voidable and refundable.

Access to Resonate Websites and Servers Maintained by the Co-op

Access to the websites and servers of the Co-operative (resonate.is, resonate.coop, et al) Site is permitted on a temporary basis, and we reserve the right to withdraw or amend the service we provide on the Sites without notice. We will not be liable if for any reason our sites are unavailable at any time or for any period.

You are responsible for making all arrangements necessary for you to have access to the Site. You are also responsible for ensuring that all persons who access the Site through your Internet connection are aware of these terms, and that they comply with them.

Privacy, Data Protection and the Sharing of Data

We process information about you in accordance with our Privacy Policy and the laws of Ireland. By using this Site, you consent to such processing and you warrant that all data provided by you is accurate.

All data we collect from you through the membership portal will be retained in accordance with the Privacy and Data Protection Policies of the Co-operative.

You agree that the Co-operative may share your data with third parties for the purposes of completing (i) their membership application process and/or (ii) their Supporter Share application process.

You agree that your data may be held by the Co-operative for the purposes of informing you of the status or proposed changes to your membership of the Co-operative and to contact you periodically to verify the accuracy of your data and to seek your consent for any other type or channel of communication.

Links from the Site

Where this Site links to other sites and resources provided by third parties, these links are provided for your information only. We have no control over the contents of those sites or resources, and accept no responsibility for them or for any loss or damage that may arise from your use of them.

Severability

Should any part of this agreement be held to be illegal or unenforceable, such provision shall, as far as it is illegal or unenforceable, be given no effect and shall be deemed to be not included in this agreement. Any part of this agreement deemed to be illegal or unenforceable will not invalidate any of the remaining provisions of this agreement.

We may agree to amend these terms and conditions in order to ensure the terms are valid, lawful and enforceable.

Tax

You should seek your own independent tax advice in relation to these terms and conditions and any transactions resulting from them. We make no warranty or representation in relation to the tax position which will apply to you after you are issued with, or purchase Supporter Shares on the Site.

Completion of Supporter Share Application Process

You will receive a confirmation of successful completion of the membership application process and you thereby warrant that your holding of shares will be consistent with these terms and conditions and with the rulebook of the Co-operative.

You warrant that if you do not complete your obligations, the purchase of Supporter Shares is voidable at the discretion of the directors of the Co-operative and any payments made will be refunded minus all reasonable costs incurred in terminating the investment and in making the refund.